The council tax you pay helps to provide local services. Find out more.

How much council tax you will pay

You can find your home's council tax band by looking at your bill or visiting our council tax bands page.

| Band | Rushmoor Borough Council (£) | Hampshire County Council (£) | Adult social care (£) | Police (£) | Fire (£) | Total council tax amount (£) |

|---|---|---|---|---|---|---|

| A | 155.16 | 874.88 | 147.28 | 174.31 | 55.23 | 1406.86 |

| B | 181.02 | 1020.69 | 171.83 | 203.36 | 64.43 | 1641.33 |

| C | 206.88 | 1166.51 | 196.37 | 232.41 | 73.64 | 1875.81 |

| D | 232.74 | 1312.32 | 220.92 | 261.46 | 82.84 | 2110.28 |

| E | 284.46 | 1603.95 | 270.01 | 319.56 | 101.25 | 2579.23 |

| F | 336.18 | 1895.57 | 319.11 | 377.66 | 119.66 | 3048.18 |

| G | 387.90 | 2187.20 | 368.20 | 435.77 | 138.07 | 3517.14 |

| H | 465.48 | 2624.64 | 441.84 | 522.92 | 165.68 | 4220.56 |

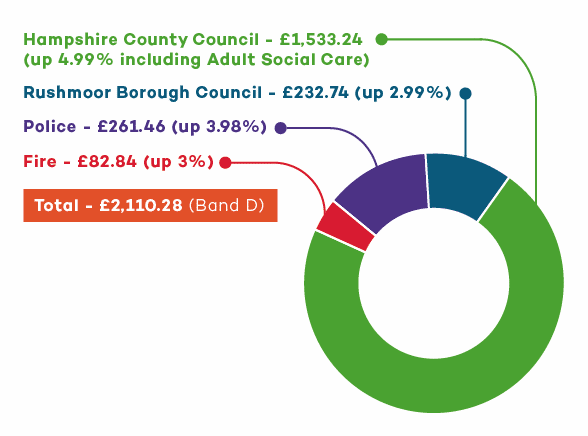

This year we have increased our part of the council tax by 2.99%. This means a rise of £6.76 a year, or around 13p a week for a Band D property.

Where your council tax goes

Although we collect council tax from residents who live in Aldershot and Farnborough, we only keep 11% of it.

We pass on 89% to Hampshire County Council, the Police and Crime Commissioner for Hampshire, and the Hampshire Fire and Rescue Authority.

For example, in 2024/25, a household living in a Band D council tax property will have a bill for £2,110.28. Out of this, we will receive £232.74, just over £4 a week, towards providing our services.

Here's how your council tax is shared out:

In total, we will collect around £70 million in council tax.

For every £1 collected, this is how it is distributed:

- 73p to Hampshire County Council

- 12p to the Police and Crime Commissioner for Hampshire

- 11p to Rushmoor Borough Council

- 4p to the Hampshire Fire and Rescue Authority

Other ways we pay for the services we provide

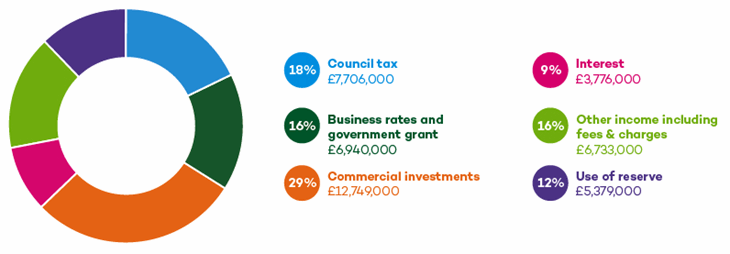

The share of council tax that we receive makes up just 18% of our total income.

We receive a further 16% of our income from government grant and business rates; 16% comes from fees and charges, 29% from our commercial investments and 9% from interest we receive on investments. We are funding 12% of our spending through reserves.

| Income | Amount |

|---|---|

| Council tax | £7,706,000 |

| Business rates and government grant | £6,940,000 |

| Commercial investments | £12,749,000 |

| Interest | £3,776,000 |

| Other income including fees and charges | £6,733,000 |

| Use of reserve | £5,379,000 |

Our commercial investments and regeneration programme

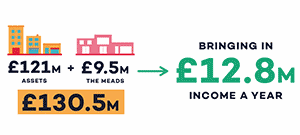

We own around £121 million in commercial assets. These include industrial units, offices and retail developments.

In addition, last year, we purchased The Meads shopping centre in Farnborough to help drive the long-term regeneration of the town centre. We are waiting for an updated valuation of the centre, but the current estimated value is £9.5 million.

In addition, we have around £41 million in regeneration assets, which will start to bring in income from this summer.

So far we have spent an estimated £3.75m on the development land at Farnborough's civic quarter and we are waiting for a full valuation on this.

We have used short-term external borrowing to support our investment and regeneration programmes and this currently sits at £173 million. The interest on this borrowing is reflected in our revenue budget below.

Operational assets used to deliver services are in addition to these, and are valued at £62.7m.

How we spend our budget

The money we receive goes to pay for more than 100 key local services, including recycling and bin collections, street cleaning, parks, play areas and leisure facilities, planning, housing, our crematorium and cemeteries, environmental health, and community safety.

We also use it to support the delivery of our key priorities, including town centre regeneration. You can read more on our Council Plan 2023 to 2026 page about what we have been doing and have planned for the next few years.

Our revenue budget pays for the day-to-day running of the council and our services.

| Expenditure | £000s |

|---|---|

| Waste, street cleaning and grounds maintenance contract | 4,916 |

| Aldershot pools | 330 |

| Property and equipment maintenance | 1,331 |

| Staff costs | 15,698 |

| Utilities, business rates and council tax | 2,167 |

| Grants to external bodies | 520 |

| Capital charges | 10,434 |

| Other costs | 7,887 |

| Total | 43,283 |

Major changes to our budget requirement

| Changes in budget | £000s |

|---|---|

| Inflation on costs | 780 |

| Inflation on income | -293 |

| Staffing increase | 959 |

| Net savings | -79 |

| Council tax increase | -258 |

| Business rates increase | -1013 |

| Net increase in funding | -167 |

| Net increase in capital charges | 4207 |

| Increase in reserves use | -4135 |

A negative number indicates an improved financial position.

Our capital spending

As well as our day-to-day revenue budget spend, we also have a longer-term capital programme for regeneration, developments and improvements.

Included in this programme are our town centre regeneration schemes, the major refurbishment of the Park Crematorium in Aldershot, disabled facilities grants, temporary housing and developer-funded projects.

Funding for this programme comes from borrowing, developer contributions, and government grants, such as the £1.2 million in Levelling Up funding and Housing Infrastructure Funding.

Contact us